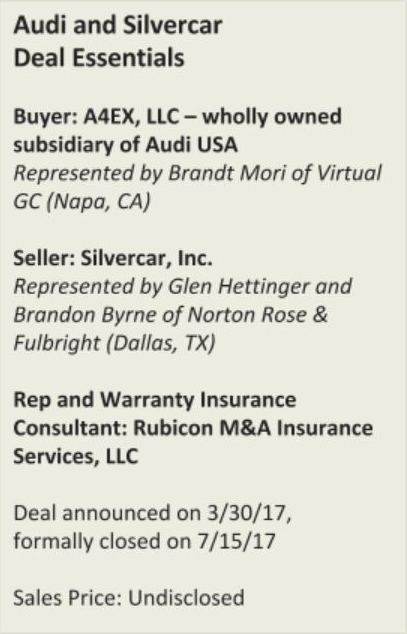

In March 2017, luxury automaker Audi, part of the Volkswagen Group, announced they were buying Silvercar, a distinctive and disruptive rental car company known for its fleet of Audi A4s in, what else, silver.

In many ways, it was a typical business acquisition – it finalized in July 2017. But for both sides, it was one of the smoothest deals they’ve ever been involved in. Buyer and seller were happy. Negotiations were painless, with less back and forth on the sales contract. And Silvercar was quickly able to continue to expand and grow.

In many ways, it was a typical business acquisition – it finalized in July 2017. But for both sides, it was one of the smoothest deals they’ve ever been involved in. Buyer and seller were happy. Negotiations were painless, with less back and forth on the sales contract. And Silvercar was quickly able to continue to expand and grow.

All in all, it was a relatively quick transition to new ownership thanks to a unique type of insurance that protects both buyer and seller and puts all the risk on a third party. Let’s get more in-depth.

The Background

If you haven’t heard of or used Silvercar, founded in 2012, it’s nothing like the typical rental car agency. It specializes in affluent travelers, especially those on business trips. You use the smartphone app to reserve your car (always a silver Audi A4) and then pick it up at the airport (a concierge takes you to the lot if it’s away from the terminal) or a city location—17 in all, from Brooklyn to L.A. You get free in-car WiFi, free GPS, free satellite radio, and you pay only for the gas you use.

Silvercar found a sweet spot in the industry thanks to its luxury edge and great customer service, and was growing quickly. It caught the eye of Audi early on, and they invested $28 million in January 2016.

Then Audi decided to buy the whole company for an undisclosed amount. It was a smart investment. Audi had their own car sharing service, but it wasn’t performing as well. As shareholders, they already knew the company’s operations. Silvercar’s innovative software and technology was part of the package. With Audi’s capital, Silvercar could expand from what was then 10 cities to their current number – and they’ll probably get to 50 easily. Besides, Audi has all the A4s they would ever need.

Both sides were ready to move forward with the acquisition.

But if you’ve ever been involved in a deal like this, you know the process can be grueling. The buyer is afraid of overpaying. And even though they’ve done due diligence and the seller is supposed to disclose any issues with the business, the buyer is also concerned about finding out something is wrong with the company after they purchase it that could render their investment worthless. There could be misstated financials, intellectual property issues, problems with the retirement plan, or some unknown tax liability.

An indemnification agreement protects the buyer in this case, allowing them to get their money back if something goes wrong. About 8% to 10% of the purchase price is generally held in escrow for several years for that eventuality.

This means the seller doesn’t get all the money from the sale right away. And they’re always worried the buyer will come up with a reason to keep the money held in escrow. Not a legal battle either side is looking forward to.

Aside from this natural tension in any business acquisition, there’s the negotiation process, which involves not only the money held in escrow and the terms of the indemnification agreement, but also all the language in the contract. The attorneys can go back and forth 20+ times with dueling versions of the document.

Smoothing Out Complicated Negotiations for Both Sides

In this deal, Audi wanted to remain protected. Even though this transaction was relatively small when you look at their annual revenues, they wanted to keep the Silvercar owners liable for up to 20% of the transaction value, half of which would be held in escrow, if the deal didn’t work out in the future. For Silvercar, which has two major shareholders and a group of smaller investors – they wanted the big payday and to not worry about Audi seeking their personal assets to recover their investment if things went south.

Enter representations and warranties insurance – insiders call it rep and warranty. You might have also heard it called warranty and indemnity insurance. With this type of policy, much less money is held in escrow, just $1 million in this case, so the seller gets most of the purchase price right away. And, the policy literally stands in the seller’s shoes for the indemnity obligation. Huge benefits.

Audi, as the much larger company, had all the leverage in this deal. So, while it was a buyer’s side policy (which are by far the most common), Silvercar agreed to pay the premium. They were happy to do it, because they were protected. If something went wrong, the insurance company would pay Audi. And that made the Audi execs happy knowing they had virtually no risk in the deal.

Not only does representations and warranty insurance protect buyers and sellers after the deal goes through, it also makes the negotiation process much smoother. Typically, attorneys split hairs on contract language and there is a lot of negotiation on the indemnification agreement and amount to be placed in escrow. But, when both sides know they are protected by insurance, the back and forth can go from 20+ versions of the sale agreement to, as it did in the case of Audi and Silvercar, six.

As you can see, a policy like this makes sense for mergers and acquisitions.

At Rubicon, the representations and warranties insurance we can put together is generally for transactions valued from $50 million on the very low end up to $500 million. The reason is that $10 million is the smallest policy you can buy, so it doesn’t make sense for lower value deals.

In general, rep and warranty insurance costs 3.5% to 4.5% of the policy limit, including underwriting fees, taxes, and the premium. It’s a one-time expense.

Getting Your Representations and Warranty Policy

To secure your policy takes a week or two. We simply send a message to the insurance company with a draft sales agreement, audited financial statements and supporting documents like disclosure schedules (if available). We’ll also tell them the terms we’re seeking at a certain rate.

The underwriters are experienced mergers and acquisitions attorneys. They’ll take a look and issue a tentative rate. If the clients decide to move forward, either the buyer or seller pays (or they split) the underwriting fee of $25,000 to $50,000 for a formal review.

The insurance company brings in outside counsel (again, mergers and acquisitions attorneys) and due diligence experts to review the disclosures and the due diligence the buyer did – they do not perform independent due diligence. The insurance company is simply doing a review of the due diligence that’s already been completed.

There’s a conference call to ask questions. And, if they get satisfactory answers, the insurance company issues the policy. A surprisingly simple process that takes a week or two. The premium isn’t paid until the deal closes.

A 2016 report from AIG found that from 2011 to 2014, claims were made against 15% of the policies they had written. The causes: financial statement issues were at the top, with taxes, contract matters, and intellectual property issues next.

Although it’s such a no-brainer when it comes to major mergers and acquisitions, thanks to the protections it affords to the buyers and sellers and speed it brings to the negotiation process, representations and warranties insurance is little-known even by experienced attorneys and business advisors and thus little-used. It’s estimated only about 13% of merger and acquisition deals in North America take advantage of one of these policies.

But that is changing. Industry watchers have seen an increase in rep and warranty insurance in mergers and acquisitions in recent years. From 2001 to 2015 the number of policies written around the world grew from 500 to 1,700 – that’s a 240% jump. Forty percent of the policies were written in North America.

As more companies and business advisors realize the protection afforded this insurance, as Audi and Silvercar did, this number is sure to grow.